2017-07-11

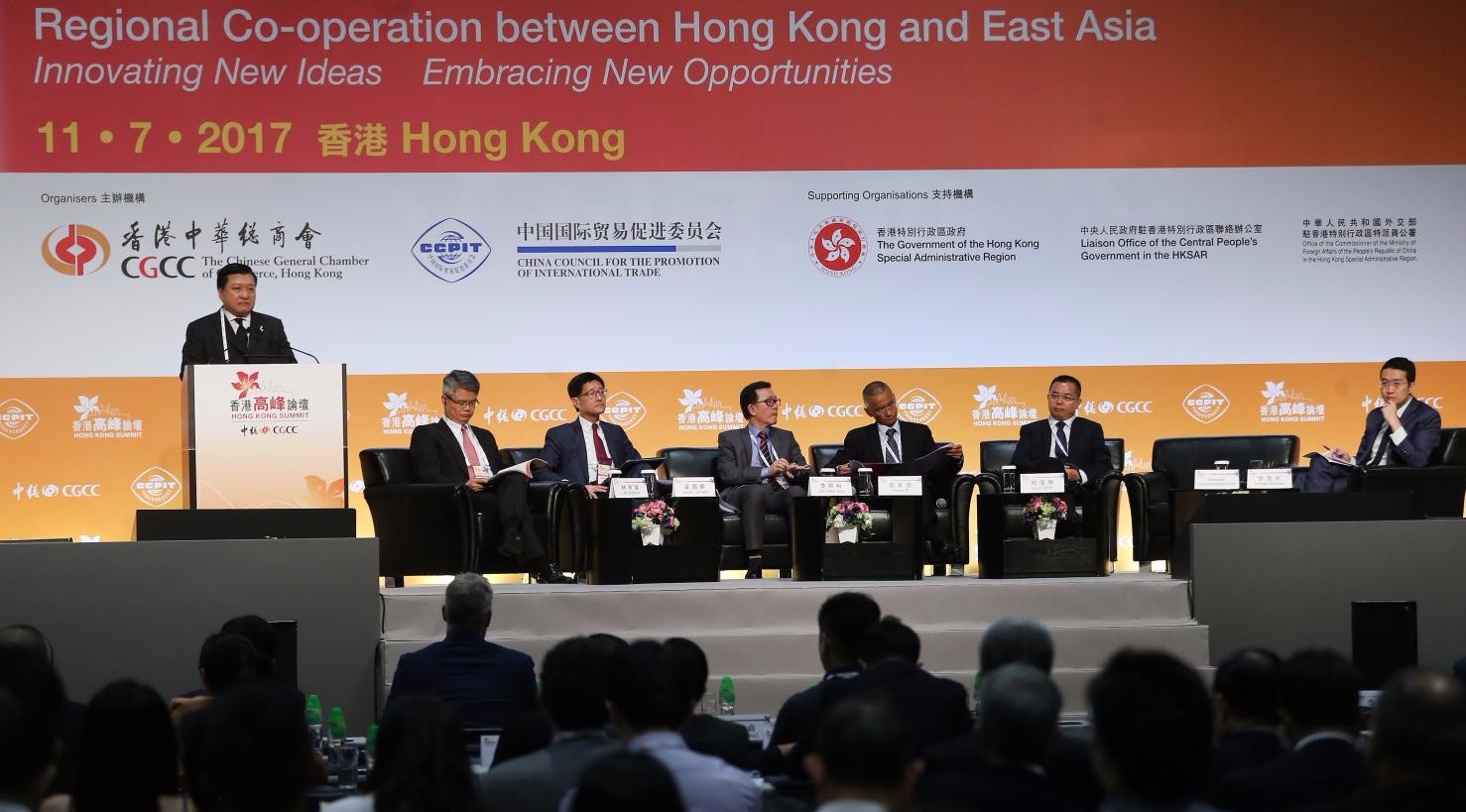

JULY 11, 2017, HONG KONG: More than 300 delegates from around the world attended the China Daily Asia Leadership Roundtable panel on “The Prospects of the East Asian Market In the New Global Economy” today at Hong Kong Summit. China Daily is delighted to work with The Chinese General Chamber of Commerce this year and hold a co-branded session as the only session strategic partner. As Asia emerges as the new locomotive for global economic growth, deepening regional cooperation has become a key strategy for development in many countries. Ministers, leaders and experts from the industrial and business sectors in Hong Kong and overseas will gather at the Hong Kong Summit to exchange ideas on a wide range of issues, including sustainable economic development in East Asia and Hong Kong’s role in regional cooperation. China Daily is delighted to have had 6 distinguished speakers: Dr. David DENG, General Manager of Capital Investment & Management Department, China Merchants Group Limited; Mr. Patrick IP, Managing Director, China-ASEAN Investment Cooperation Fund; Prof. KRIENGSAK Chareonwongsak, President, Institute of Future Studies for Development; Mr. LEE Heng Guie, Executive Director of Socio-Economic Research Center, The Associated Chinese Chambers of Commerce and Industry of Malaysia; Mr. Lincoln LEONG, Chief Executive Officer, MTR Corporation Limited and Mr. LIN Jingzhen, Deputy Chief Executive, Bank of China (Hong Kong) Limited. They reviewed the opportunities and challenges for the region’s financial markets, Hong Kong’s advantages in financing East Asia’s infrastructural projects, and the interaction between traditional and high-tech industries. Dr. David DENG expressed that China Merchants Group plays a pioneer role in Belt and Road Initiative and created its PPC (port-park-city) model to catch opportunities in the Belt and Road regions. Deng said the flagship of its industry platform is China Merchants Port, which has 49 ports in 19 countries and regions, and CMG’s logistics sector has 96 overseas operating sites in 38 countries and regions worldwide. Mr. Patrick IP said “According to Asian Development Bank, the annual infrastructure spending required in Asia is around US$ 1.7 trillion, I think the government can make up around 20% of the fund required and for private sector 10%,so you can see the investment gap in infrastructure is huge. And infrastructure is essential to a country's GDP.” Prof. KRIENGSAK Chareonwongsak said that even though competiveness of the region is increasing, but it is increasing not as the speed that it should be, because the region has not been properly digitalized. This is a major issue in my assessment in looking at the future of the region. Mr. LEE Heng Guie pointed out that Regional integration is important. The government, institution and central bank need to share information to avoid the next financial crisis. A lesson to learn from the 1997-1998 and 2008-2009 financial crisis is that not just deepen our integration from financial and economic (aspects), but also we need to share information. Mr. Lincoln LEONG stressed that urbanization would be the key driver of infrastructure, retail and education and so on. He also mentioned the connectivity would further enhanced by the Hong Kong-Zhuhai-Macao Bridge and the Express Rail Link, while at that time we could enjoy a trip to Guangzhou within an hour, and around 10 hours to Beijing. He also mentioned that the Hong Kong-based railway operator is eying on projects in Asian countries, like Indonesia, Thailand, India, etc. Mr. LIN Jingzhen highlighted that he believes in the potential economic growth of East Asia as Asia has become the key driver of the global economic growth. Despite East Asia has experienced few financial crises, it will still show its economic significance and Hong Kong can play its role as financial service provider regarding the expected global infrastructure investment to reach $260 million in 2030 and East Asia will contribute more than 60 percent of the total amount. He also pointed out that Hong Kong can attract investment from East Asia as an offshore (RMB) financial centre, as the use of Renminbi became more popular in East Asia while more and more countries start to include yuan in their foreign exchange reserves. -- Ends -- About China Daily Asia Leadership Roundtable China Daily Asia Leadership Roundtable is a by-invitation network of movers and shakers in Asia providing platforms for focused dialogue, issue investigation, and possible collective action on strategic issues relating to economic, business and social development in Asia. Our aim is to enhance communication and increase mutual understanding between China, Asian and Western countries. Roundtable events are held in major cities across Asia. Media Contact: Ms. Cindy Chan Tel: (852) 3465 5431 Email: cindy@chinadailyhk.com