2021-12-08

Zhou Mo in Shenzhen and Ao Yulu in Hong Kong

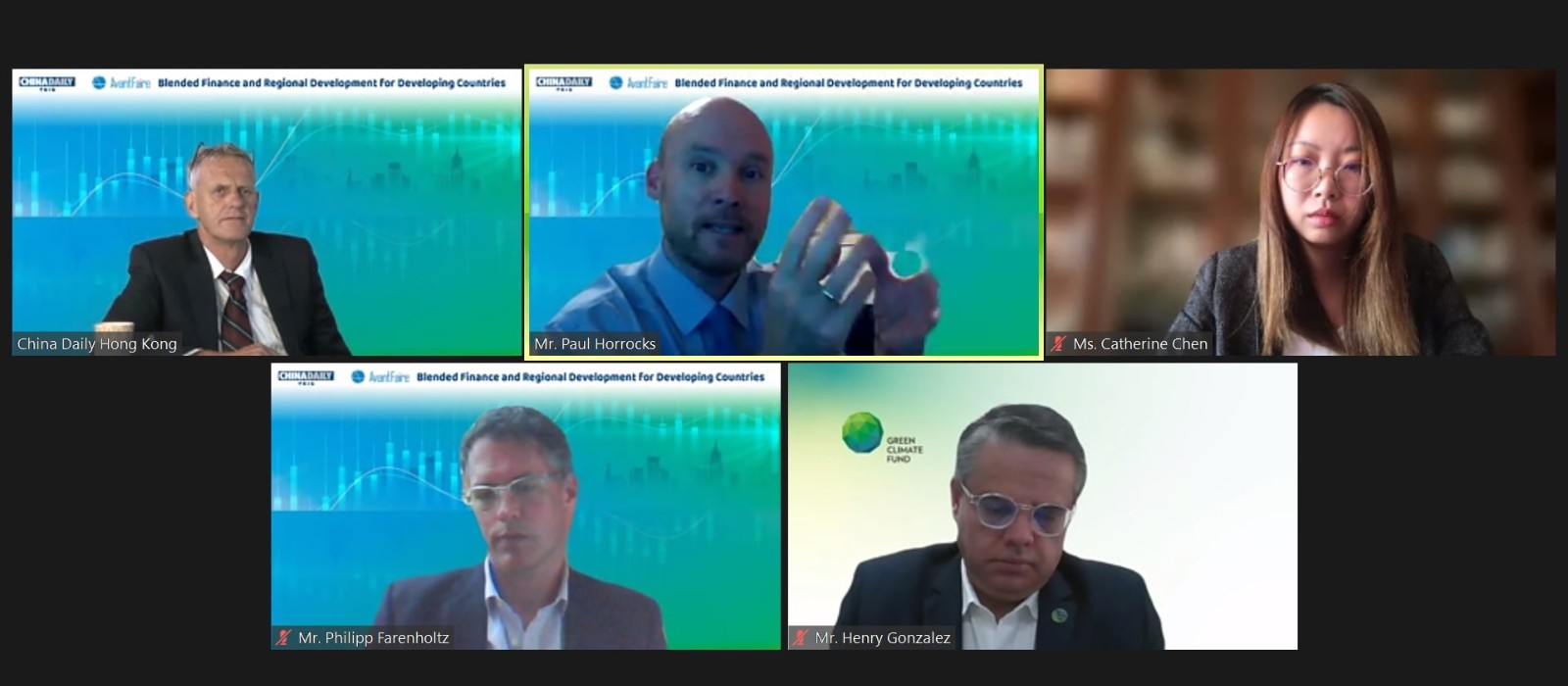

Participants at online roundtable forum also warn to be vigilant of those who would use tool to distort markets Blended finance is an important tool for helping achieve sustainable development goals and driving growth in developing countries, but rules should be strictly followed to avoid market distortions, experts and industry leaders told a roundtable forum on Tuesday. Xavier Michon, deputy executive secretary of United Nations Capital Development Fund, said blended finance is an “absolute necessity” for sustainable development of less-developed countries. Michon made his remarks at the virtual forum, titled “Blended Finance and Regional Development for Developing Countries”. The event was co-organized by China Daily and AvantFaire Investment Management Ltd. The Organisation for Economic Co-operation and Development defines “blended finance” as “the strategic use of development finance for the mobilization of additional finance towards sustainable development in developing countries”. “Even prior to the COVID-19 crisis, domestic resource mobilization was a tremendous challenge for LDCs, which is why they have relied to a large extent on external finance; namely, development finance, remittances, and investment,” Michon said. “Most importantly, official development assistance alone is simply not enough to finance the SDGs,” or sustainable development goals, Michon said. “We need blended finance because we need to attract robust flows of capital to finance projects that have commercial impact, that have development potential and that lack the kind of profile that would typically attract commercial finance.” Avantfaire founder and CEO Catherine Chen said the reason that blended finance has become popular globally is that it blends the private and public sectors and creates a win-win situation. “Blended finance creates mobility, which means that more private capital participates in the financing of development projects that would not be considered in the past,” she said. “With bigger private capital to participate, there will be a bigger scale of development for those projects. That means that a bigger absolute impact of the society will be created.” Investing in partnership with private entities will bring new investment perspectives and additional business efficiencies to the public entities, while private managers, in turn, will also get experience from their public counterparts on how to add value to the national and international development agenda, such as the Paris Agreement and the SDGs of the United Nations, Chen added. Philipp Farenholtz, investment officer of blended finance department at International Finance Corp, stressed the importance for market players to “play by the same rules”. “There is a lot of potential to distort markets, and we all have to be very careful that we use blended concessional funding in a very reasonable way. Otherwise, some actors may use blended finance to compete, and distort markets,” he warned. He said IFC is leading a working group that focuses on promoting a set of principles on blended concessional finance with the aim to “ensure that the use of blended concessional finance is transparent and in line with these principles to avoid any kind of market distortions”. Citing the organization that he works for, especially how it operates in the private sector, Henry Gonzalez, director of Private Sector Facility at Green Climate Fund, spoke on how the financial mechanism mobilizes capital from the developed world to the developing world as a way of compensating for climate change. He views blended finance as a tool and an opportunity that could bring private and public capital together and have each play the role they should be playing. “Public capital should be open to risks, open to innovation, and open to invest in an earlier stage. And then private capital is there to scale to take it to the other level, to provide a standard,” he said. Paul Horrocks, the OECD’s head of Unit for Private Finance for Sustainable Development, also pointed out that blended finance can help bridge the investment gap for the SDGs if a common framework is completed, as well as offer a way to mobilize the private sector. “A lot of pension holders nowadays want to invest in the SDGs for the long term. For the SDGs, the gaps are significant, and the opportunities are also very big. Blended finance allows private capital to tap into those opportunities in developing countries where future growth and future needs for financing are the most significant,” he added. Horrocks said the biggest obstacle for increasing blended finance activities is the scale of the capital and how to mobilize it well. To tackle this problem and help developing countries transform, several tools may work, which include capital constraints, national regulations, and the use of more-effective guarantees to scale and bring in a large amount of capital, he said. Contact the writers at sally@chinadailyhk.com